SAP ECC Under Brazil’s 2026 Tax Reform: A Manufacturing Use Case

- Qubittron

- 1 day ago

- 2 min read

Brazil’s 2026 tax reform is already forcing SAP ECC decisions.

In 2025, Alkegen, a global specialty materials manufacturer operating in Brazil reached a pivotal moment. The company ran SAP ECC 6.00 in a non-Unicode environment with years of custom development, just as Brazil prepared to implement one of its most far-reaching tax reforms.

Regulatory timelines were fixed, guidance continued to evolve, and the business had no tolerance for disruption. The organization faced a real and immediate enterprise risk, not a theoretical technology exercise.

The Situation: A Complex SAP Landscape Under Regulatory Pressure

Like many long-standing manufacturers, the Alkegen had tailored SAP ECC extensively to support core business and financial processes. Brazilian operations relied on the system for SPED compliance, NF-e integration, and statutory reporting accuracy.

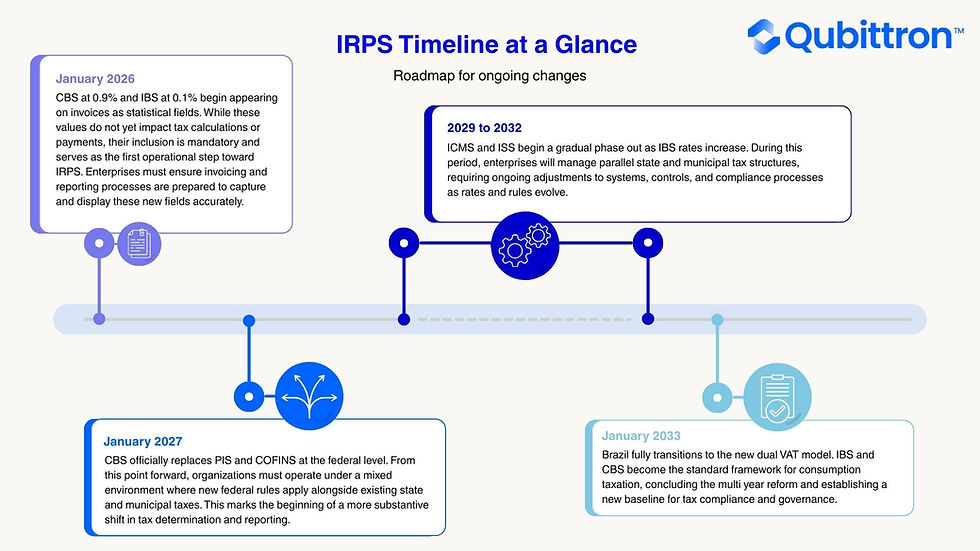

Brazil’s 2026 tax reform introduced changes that directly affected tax calculation and reporting logic inside SAP. At the same time, the organization needed to complete a Unicode conversion and ECC upgrade before regulatory changes took effect.

With deadlines that could not move and late SAP Notes introducing uncertainty, the margin for error narrowed quickly. Any misalignment between system readiness and regulatory requirements would expose the business to compliance issues, audit risk, and operational instability.

Why This Became a Leadership Level Decision

This was not just an IT decision.

Finance, tax, and IT leaders needed confidence that SAP changes would not compromise compliance, audit readiness, or production stability. The real question was whether the organization could modernize SAP ECC while staying in control of regulatory and operational risk.

How the Organization Changed Its Approach

Instead of treating modernization and tax readiness as separate efforts, the organization aligned them.

ECC upgrades and Brazil tax preparation moved forward together. Custom code risk was addressed early. Local Brazilian validation ensured regulatory alignment. Clear ownership across testing and governance reduced uncertainty throughout execution.

This approach allowed progress even as external guidance continued to change.

The Outcome

The manufacturer prepared for Brazil’s 2026 tax reform without destabilizing its SAP environment. Operations remained steady, compliance confidence improved, and long-standing ECC complexity was reduced. Leadership also gained a clearer path toward future modernization, including S/4HANA.

Why This Use Case Matters

Many SAP ECC customers in Brazil face similar conditions today: mature environments, heavy customization, and regulatory timelines that leave little room for delay.

This use case demonstrates how organizations can manage regulatory change more effectively when they treat SAP transformation as a business risk initiative rather than a standalone technical project.

Download the whitepaper to see the full use case, execution approach, and lessons for enterprises operating SAP ECC in Brazil:

Comments